Miscellaneous Itemized Deductions 2024

Miscellaneous Itemized Deductions 2024 – What is the 2% rule for itemized deductions? Before 2017, the 2% floor rule limited itemizing miscellaneous expenses. Taxpayers could only claim miscellaneous expenses that exceeded 2% of their AGI. . For roughly 1 in 10 taxpayers, itemizing deductions — rather than claiming the standard deduction — is the better game plan. Here’s why. .

Miscellaneous Itemized Deductions 2024

Source : www.marcumllp.comTax Mack Copy Center | Miami FL | Facebook

Source : m.facebook.comTax Reform Resource Center Alloy Silverstein

Source : alloysilverstein.comTax Deduction Definition: Standard or Itemized?

Source : www.investopedia.comDeductions memes. Best Collection of funny Deductions pictures on

Source : br.ifunny.coIKE & Cookie Tax Consultants | Halethorpe MD

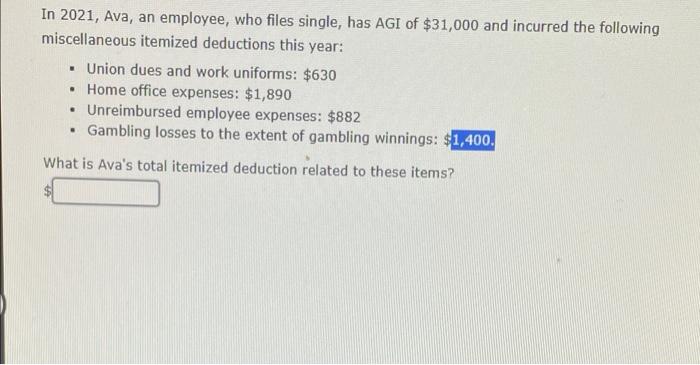

Source : www.facebook.comSolved In 2021, Ava, an employee, who files single, has AGI

Source : www.chegg.comGiron’s Process Services

Source : m.facebook.comUpdated Standard Mileage Rates for 2024

Source : markham-norton.comSusanne Mariga, CPA

Source : m.facebook.comMiscellaneous Itemized Deductions 2024 Tax Partner Michael D’Addio explains in Bloomberg Tax how the : If you worked remotely in 2023, you may be curious about the home office deduction. Here’s who qualifies for the tax break this season, according to experts. . Learn more about it. Itemized deductions are expenses you have incurred throughout the year that can be used to reduce your taxable income. It can be taken in lieu of the standard deduction—a .

]]>

:max_bytes(150000):strip_icc()/tax-deduction.asp-Final-163716aa2a244bac8f059f5e289bf913.png)